Integration Process & Services

Overview

The integration process involves a number of steps and procedures, described in broad outline in the sections below.

You should be familiar with these as you begin to build your Cardlytics integration with the API or SDK.

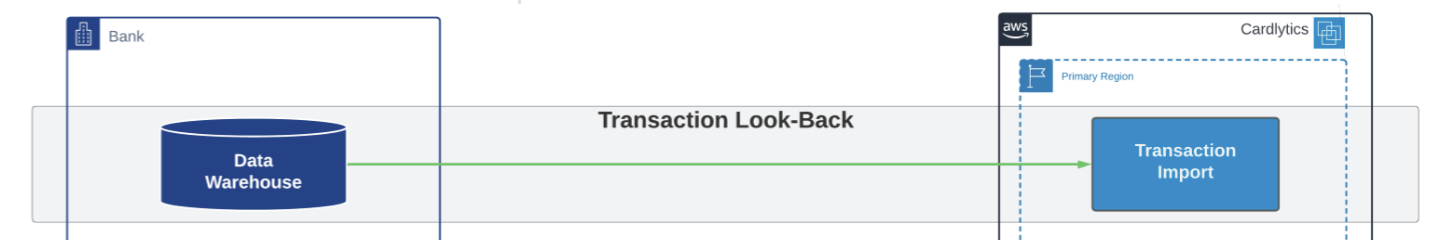

Transaction Look-Back

You'll need to provide Cardlytics with a one-time export of the previous 13 months of transactions in order to seed Cardlytics projection abilities with Cardlytics merchants, and help guide a transaction mapping exercise. This data can be fed to Cardlytics through different channels like SFTP, S3, and so on.

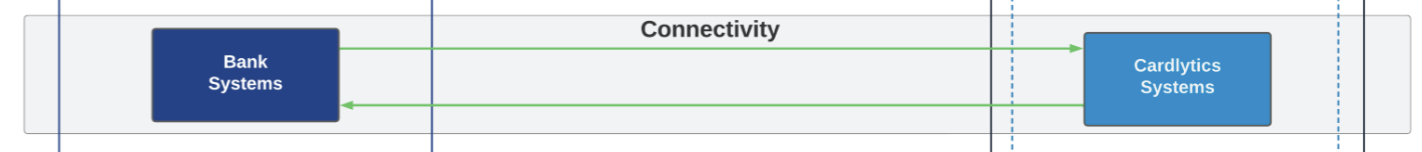

Connectivity

You must establish connectivity for ongoing data transfer and services. HTTPS and sFTP over mTLS + IP-Address-Allow-List is our standard. Cardlytics is hosted across two regions and multiple availability zones in AWS. For more detailed information, refer to Connect via mTLS.

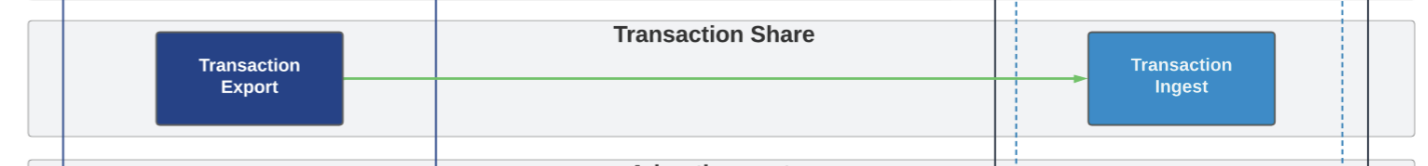

Transaction Share

Ongoing near real-time feed of Authorization transactions and frequent bulk "upload" of Settlement/Clear transactions. Authorization transactions will be sent as quickly as possible to the transaction API. Settlement transactions can go to the API or to a bulk file import.

Note that transactions encode the payment method, account, and customer to which they are tied. Cardlytics does have support for more complicated customer and account relationships.

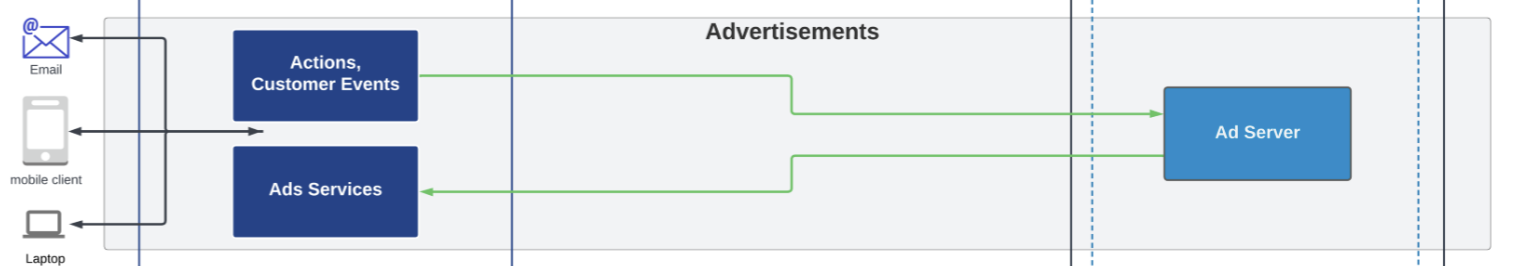

Advertisement

Ad (offer) Display and ongoing customer data share of Activations, Clicks, UI Events, Customers, Accounts, and Transactions. The Cardlytics Ad Server handles all synchronous traffic to service your customers.

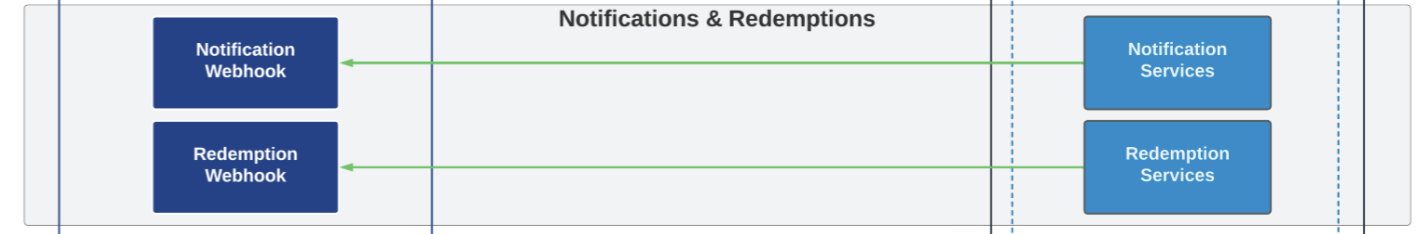

Notification & Redemption

Cardlytics also shares notifications of potential redemptions and fulfillment of qualified redemptions. The bank can react to notification like potential redemptions for more near real-time engagement with customers. Cardlytics has a suite of notifications that can be subscribed to. See the section on Notification webhooks for more information.

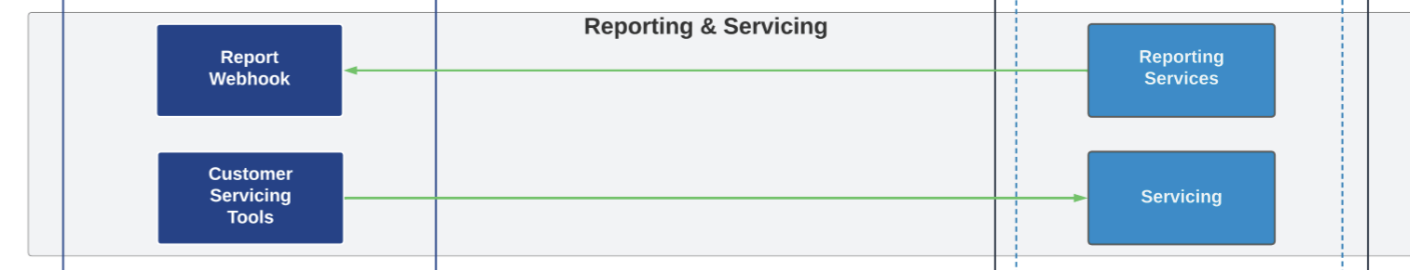

Reporting & Servicing

Cardlytics makes available a suite of reports and customer servicing tools to help the bank monitor and manage the program. Servicing APIs are available to open "missing reward" research tickets, and to discover Cardlytics' latest known disposition for a transaction and reward. A suite of reports can provide insights into Program Status, Redemptions, Data Sync Status, etc.

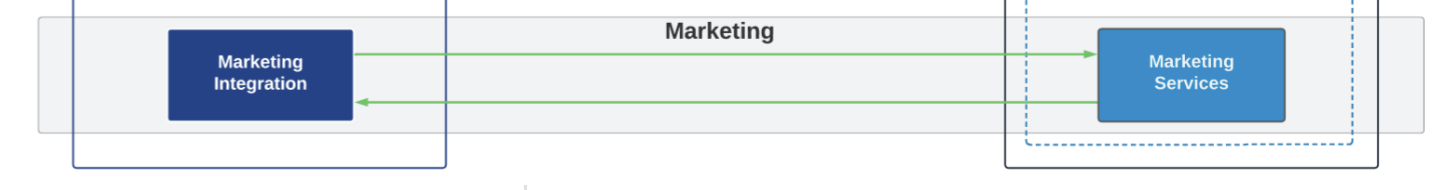

Marketing

Once the offer program is up and running, Cardlytics works with the publisher on different marketing packages to increase customer engagement with the program. Cardlytics has a suite of alert packages to help set up objective-based marketing campaigns. For mass marketing communication, Cardlytics services can be tuned to handle large spikes of traffic.