Publisher Platform v2.0

Overview

Cardlytics is an advertising and data-centric platform that operates in bank channels. Built on the insights of transactions and the aggregation of data, the platform works by helping publishers serve a wide range of Advertisements (Ads) for Merchant Offers. The Ads are primarily offers from merchants that deliver cash back to bank customers.

Merchants and Publishers benefit from rich customer insights, new monetization opportunities, and measurable marketing outcomes that drive growth.

The v2.0 Publisher platform is based on a virtuous cycle of data, insights, and rewarding experiences for all participants.

Value Proposition

Our v2.0 platform provides you with an end-to-end rewards solution and handles everything from facilitating offer discovery to rewarding your customers.

We provide Cardlytics' developers with supporting tools that include a standard billing and reporting suite, as well as marketing playbooks, and dedicated account servicing.

As a Cardlytics Publisher, you can take advantage of our publishing solution and increase card value by leveraging our rewards program.

Transaction Process

The platform works by ingesting transaction data from a Publisher in order to curate a customized assortment of offers for the publisher's customers.

Typically, Publishers send batches of customer, account and transaction data to Cardlytics via API requests to requisite Data API endpoints.

Integration Paths

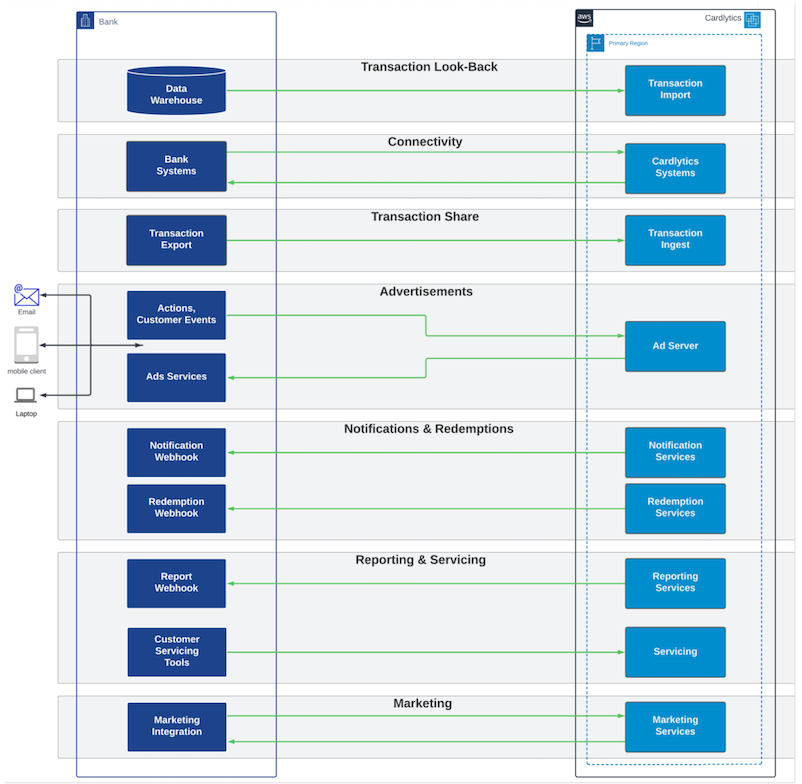

The Cardlytics platform is comprised of two different front-end integration paths (SDK or API) and a suite of APIs that cover transaction ingestion, notifications, redemptions, servicing and marketing. Through data exchange, you can build a complete rewards experience for your customers, with a suite of supporting products that enable program operations.

See the section on Integrations for details on how to set up your sandbox environment and connectivity using mTLS for mutual authentication.

For details on how to get started with building your integrations, see the section Getting Started.

Important

All new Cardlytics publishers should use the v2.0 platform version to build their integrations. The v1.0 platform is still supported for existing bank and institutional customers. Details on migrating from v1.0 to the v2.0 platform are forthcoming.

How Offer Ads Work

Once you have integrated with the Cardlytics platform, you can present Ads for offers of cash back to your customers for shopping at specific merchants and purchasing certain goods and services.

Cardlytics provides you with a set of APIs that allow you to retrieve offers for display to the end customer. These APIs let you communicate and update customer information needed to display targeted offer advertisements.

As a customer interacts with an Ad on their mobile or desktop device, the merchant Ad will go through one or more status changes in relation to that customer.

For customers to realize the full value for most Ads, they must:

- Be served the offer by the Publisher from the Cardlytics platform.

- See the offer.

- Activate the offer.

- Redeem the offer by making a qualifying purchase.

- Await their cash back.

Developer Tools

You can take advantage of a wide range of tools and services to advance and accelerate your development efforts, including

- REST API features, services and enhancements

- Real-Time-Messaging for posting events to Publishers

- Notification Webhooks for customer communications

- Reporting and Reconciliation metrics

- Rewards Settlements data for Publishers

Full Stack Framework

The Cardlytics platform is a full stack framework that provides you with the tools you need to build a complete end-to-end rewards solution. The platform handles everything from facilitating offer discovery to rewarding customers.

The end-to-end flow is illustrated in the diagram below.

See the section Integration Process & Services for more detailed information on how the overall platform works and what you need to know in order to move ahead with integration.

Customer Support

In addition to marketing and partner support, Cardlytics provides you with a Customer Service Representative (CSR) tool designed to help bank Customer Service Representatives resolve customer issues. These issues may involve informing customers about the state of their redemption or providing the option to credit a courtesy redemption.

Reach out to your account manager for more information on how to access and work with the CSR tool.

Partner Support & Feedback

Your feedback and comments are important for the Cardlytics product and engineering teams.

Reach out to your account manager to provide feedback and address any issues of concern.

For documentation updates, changes and fixes, contact tom.maremaa@cardlytics.com either by email or on slack to provide input.